Borrow

Summary

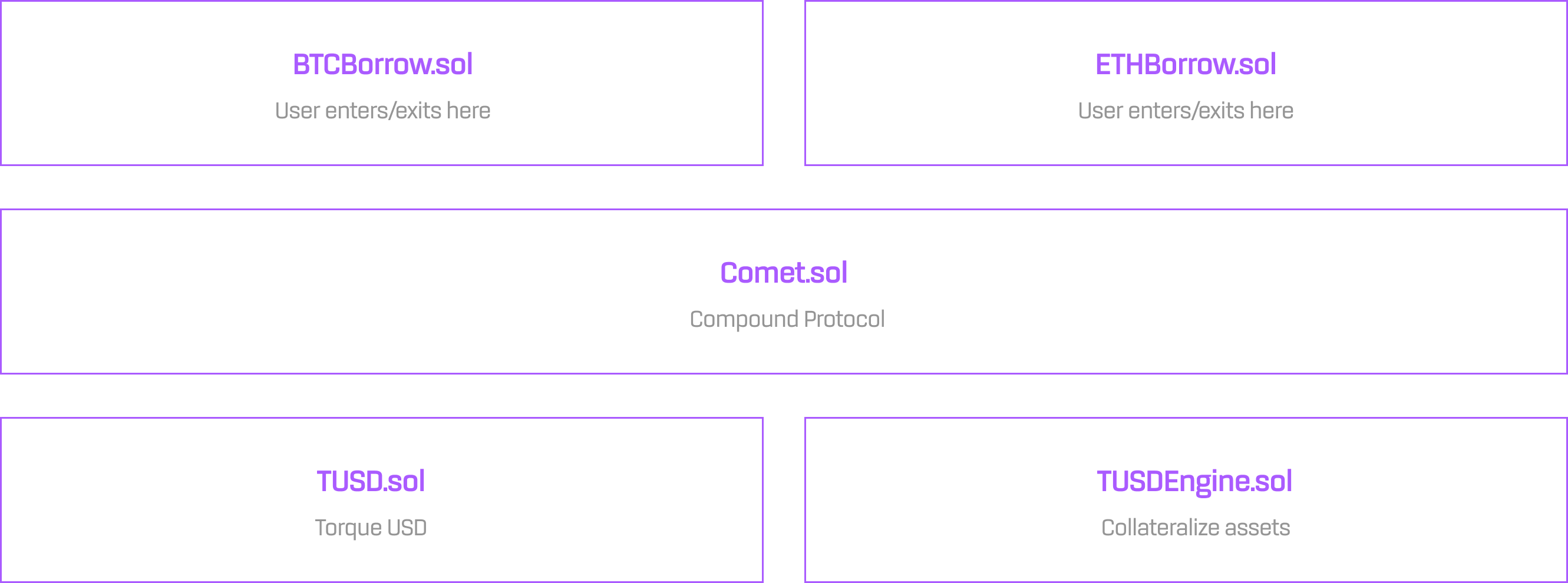

Boost paired with Borrow enables a powerful saving experience. When borrow is called, a new loan position is created by routing wrapped Bitcoin or wrapped Ether collateral to Compound, and the borrowed asset is delivered to users. In the case of Torque USD (TUSD), USDC becomes protocol reserves to be deployed across yield strategies.

The purpose is to maximize capital efficiency and yield generation for borrowers.

Alternatively, when a user calls repay, the position is unwound.

Compound V3

Compound V3, popularly known as the Comet deployment, is integrated with Torque for credit lines. This integration enables Torque to establish best-in-class loan rates for savers as TORQ and other external incentives accrue to positions.

TUSDEngine

The TUSDEngine is responsible for minting, burning, and liquidating positions related to Torque USD. Functions are called by users and related ecosystem contracts publicly. It is mandated to maintain peg at $1.00 for mint and burn via Chainlink oracle. The price of Torque USD on secondary markets generally remains stable as liquidity is concentrated but may fluctuate depending on market conditions. Thus, in the event secondary markets experience a depeg event, users are incentivized to purchase it and redeem at the TUSDEngine for $1.00 of backing assets.

Liquidations

To liquidate a user who has an underwater loan, call liquidate at the TUSDEngine and pass collateral address, user address, and debtToCover amount in TUSD. This is the debt a liquidator is repaying for the borrower to ensure protocol health. Liquidators receive a 10% bonus from the borrowers collateral for performing the liquidate function.